Investing in new equipment. How the Numbers work.

- 09

- Oct

- 2023

- Posted Byadmin

- InHomepage

- No Comments.

New Equipment:

The TRUTH is in the Numbers.

If you are Wrestling with an Equipment purchase decision, someone might be distracting you with Shiny irrelevancies. We’ll show you and your accountant the Truth in the Numbers.

ABC Specialist Medical Centre Pty Ltd opened in 2002. The owner is Dr Smith, a medical specialist, who works full time in the practice. Dr Smith is a very busy man and his waiting room is always filled with patients.

Freddie Jones works for XYZ Equipment is trying to sell Dr Smith a $120,000 piece of equipment.

Being the busy Doctor that he is, Dr Smith tells Freddie that the asset is far too expensive at $120,000 and he needs to heavily discount his price.

Freddie, decides he can offer a discount of $20,000 but understands that the Purchase Price wouldn’t be so much of an issue, if the Doctor financed the machine, the monthly cost would then be so much easier to manage. Freddie calls me and we have a discussion.

I speak to Dr Smith so that I can listen to his motivations and concerns.

I act for him and help him and his accountant agree a strategy based largely on the Truth of the Numbers.

There are THREE main pillars. COST -v- REVENUE over TIME.

The relative benefits of any particular Brand are for equipment salespeople to talk about.

We don’t mind which Brand is purchased. After all, clients are the best people to decide the equipment that gives the best results to their patients and their practice.

Often practice owners can get caught up on purchase price, interest rate, monthly cost etc and the months drift by. These things really become less important if there is a sound commercial plan for the equipment or asset.

Listening to Understand

I meet Dr Smith and gain a full understanding of his practice, lifestyle and demands on his time. I ask him why he is seeking to buy the equipment and learn that it is a replacement for an older, slower, inefficient machine that provides poor images and is expensive in terms of consumables, down-time and repairs.

Whilst the machine isn’t a core asset of the business, when it is not working properly or at all, it causes inconvenience for the whole practice. By default it is negatively affecting patient outcomes and practice efficiency.

Dr Smith has spent many years nurturing his practice and his professional reputation, so he is also concerned that poor quality, outdated equipment reflects badly on his clinical ability as far as his patients’ PERCEPTION is concerned.

The Numbers on a $100K example

I advise Dr Smith that if we start with the numbers we can work back from there. Typically a $100,000 asset financed over a 5 year term, as a Chattel Loan will cost under $2000 per month with almost any Bank.

I ask how many treatments per week he is currently performing with his current equipment and the charge-out rate for each treatment.

| Treatments per week | 5 | |

| Charge rate | $150 | |

| Income |

$750 per week or $3000 per month |

I ask the Doctor if he had the new machine, which is faster, more reliable, easier to use, giving better imaging and therefore better patient outcomes how many treatments he would perform each week.

| Treatments per week | 10 | |

| Charge rate | $150 | |

| Income | $1500 per week or $6000 per month |

I remind him that he would have finance payments of $2,000 per month out of the income of $6,000 per month but the purchase makes commercial sense and shows a good return on his investment.

In fact Dr Smith’s real loss has been the 3 months he has spent negotiating the purchase price.

As well as the clinical and patient benefits, the efficiency will deliver back to him something that cannot be bought back once spent – TIME.

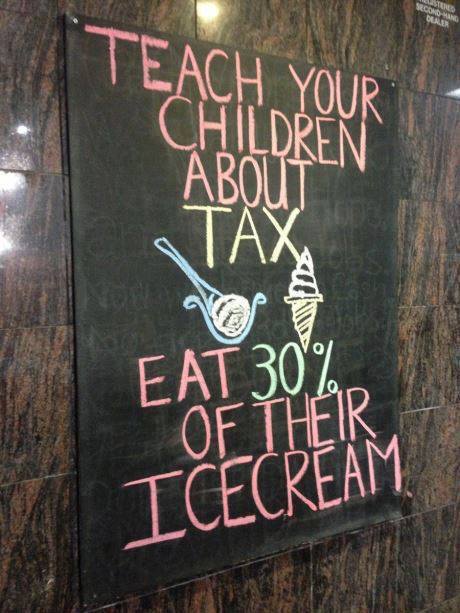

TAX Effect

I work with each client’s accountant to make sure that the appropriate Tax Deductions for depreciation, installation, on costs and interest are claimed.

Remembering ATO’s depreciation rules have changed so be sure to gain your accountant’s counsel.

Installation & Co-Ordination

Dr Smith agrees an ideal install date and I co-ordinate with the financier & supplier to make that happen. I work for each client so that installation and payment is on time and on budget.

Having said all that if an asset is not going to at least pay for itself PLUS a return for clients, I am duty bound to advise them to seriously re-consider the purchase.

There are still many clients for whom a new Motor Vehicle is just as valid a purchase as income producing equipment. It’s all about gaining an understanding of the Numbers and making informed decisions from there.

With over 20 Years in Healthcare Financing and with 30 Lenders on our panel I am sure I’ll have some useful insights no matter what your situation.

If there is something you would like to discuss, I would love to hear from you. RELAX and give me a call.

Steve Daley 0413 619 824 Steve@HealthcareFinance.com.au

Managing Director

Healthcare Financial Strategies

DISCLAIMER

The above is general information only and is NOT accountancy or Tax advice. Accordingly, the information on this site is provided with the understanding that the authors and publishers are not herein engaged in rendering legal, accounting, tax, or other professional advice and services. As such, it should not be used as a substitute for consultation with professional accounting, tax, legal or other competent advisers. Before making any decision or taking any action, you should consult your accountant or advisor.